We process weekly pay runs, monthly IAS, superannuation lodgement and end of year payroll summary.

How can we help

you today?

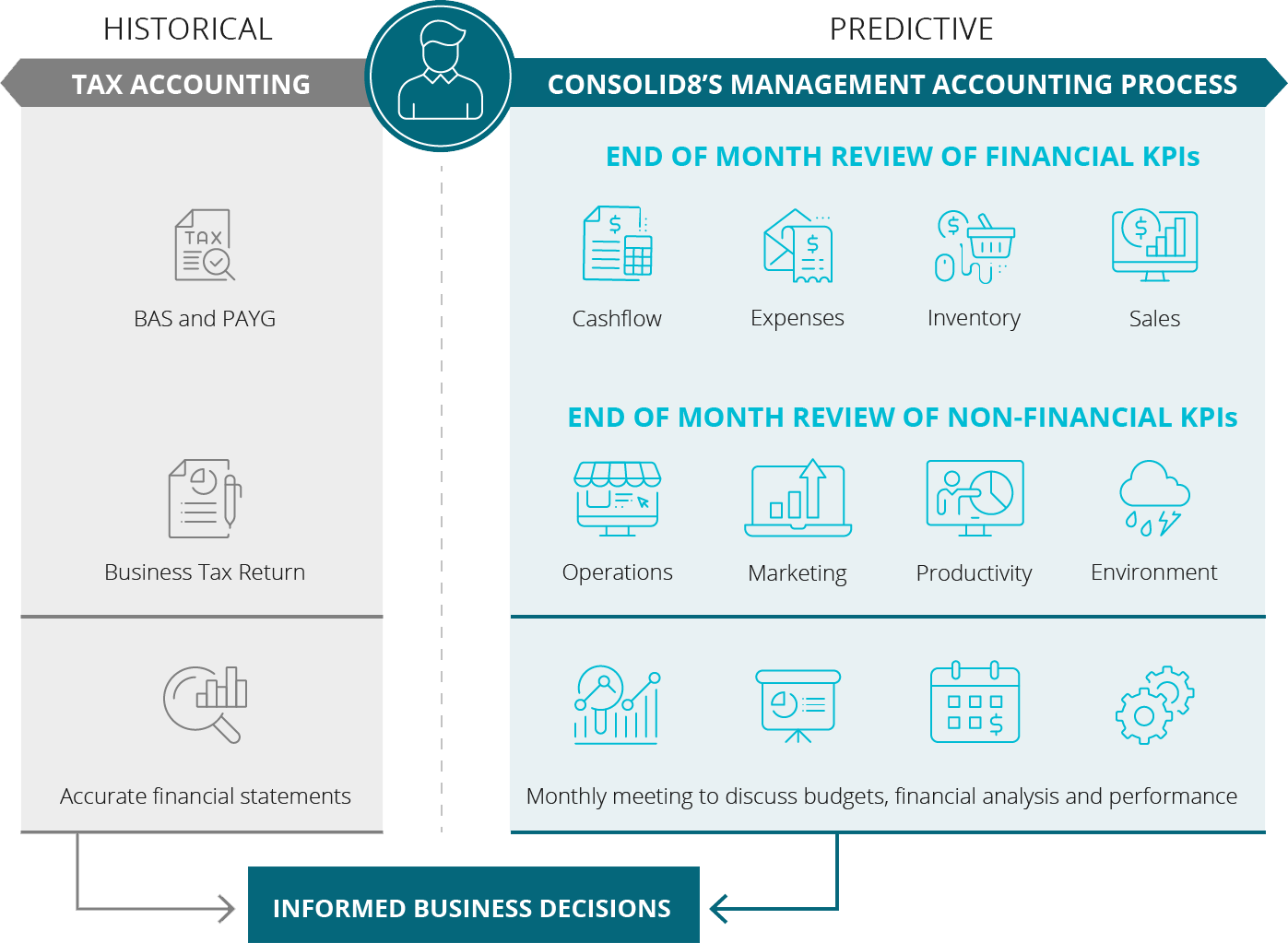

Management accounting helps you make informed decisions in your business

Our team of management accountants focus on looking forward (instead of focussing on historical data). Each month, we provide you with accurate, up-to-date financial reports. We also meet with you monthly to review the data, flag any areas of concern and discuss improvement strategies to keep you and your business on track.

Create a management accounting solution that works for your small business

We recognise every business is different. Our management accounting solution is structured so you can customise a package that works for your business. Pick and choose what you need, then we’ll build a solution to suit.

Payroll

Reconciliations and BAS

We process and review bank reconciliations for all your business accounts and prepare and lodge Business Activity Statements.

End of Month Reports

We deliver monthly management reports featuring Profit and Loss, Balance Sheet and business performance metrics.

Financial Analysis

Using cloud-based tools, we show how your business performs compared to KPIs, profitability and growth targets.

Monthly Meetings

Each month we meet to review financial reports, flag areas of concern and discuss improvement strategies.

Cloud Software Integration

We are experts in cloud-based accounting software and certified in most e-commerce, POS and inventory solutions.

Looking for

something else?

Insights

Stay on top of your growth and goals with expert industry insights and articles

Read More >