Profitable businesses have a higher value. We identify new ways to create efficiencies, reduce expenses and increase revenue.

How can we help

you today?

Owners with investment requirements, expansion plans or reaching retirement will benefit from understanding the true value of their business and how to increase the earnings before interest and tax (EBIT) multiples. This is what our business valuation services provide.

Selling Your Business

Know the true value of your business and how to increase the EBIT multiples.

Retiring From Your Business

Retire with financial security by growing the value of your business.

Investing in Your Business

Secure capital injection from lending institutions or private equity.

Calculating the value of your business

The valuation report starts with a comprehensive risk assessment, which analyses multiple factors that influence the value of your business. We review the business’ cash flow and normalised profits, enabling us to accurately determine the true value of your business.

Business risk profile + Business cash flow + Normalised profit = Valuation

Strategies to increase the value of your business

Increase Profitability

Stabilise Cashflow

Established revenue and predictable cash flow attracts a higher business valuation, so we work to lock in revenue streams and formalise sales contracts.

Improve Systems

How well your business can operate without you as a business owner has a big impact on its value. We develop and document systems and processes so the business is less owner dependent.

Leverage Staff

Skilled, knowledgeable employees increase business value. It’s worth the time and effort to cultivate a high quality workforce and build incentives for key staff.

Physical Assets

Well maintained physical assets, including office space and plant equipment, will help realise maximum business valuation.

Intangible Assets

Protecting intangible assets like intellectual property, trademarks and customer databases boosts value.

Looking for

something else?

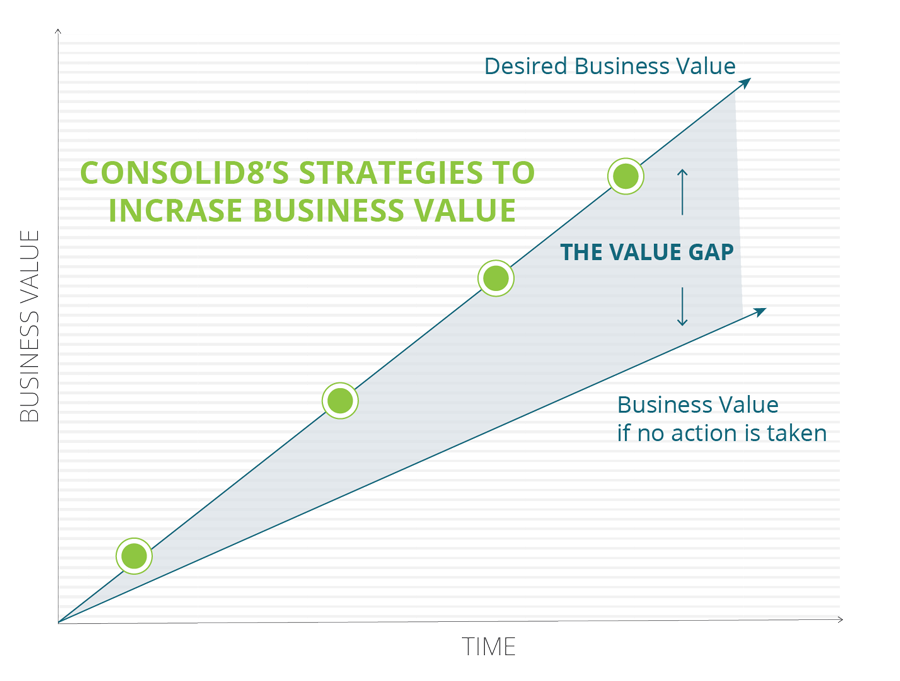

Strategic solutions to help close the value gap in your business

To get the maximum value out of your business you need to plan ahead

Like any financial plan, if you are basing your retirement on the eventual sale of your business, you need to be prepared. Start by understanding the value of your business now. Then identify how much you need to generate from the sale of your business to retire comfortably. The difference between these two figures is what’s known as the Business Value Gap.

How to bridge the gap?

Once you know what the gap is, you can put in place a strategy to increase your business value. You may need to delay your retirement plans for a few years, but if that means you can retire comfortably, it is probably worth it.

Having your own business gives you the power to write your own retirement cheque. Having a business adviser on board to help you bridge the Business Value Gap means you can maximise the size of that cheque.

Insights

Stay on top of your growth and goals with expert industry insights and articles

Read More >Cyber Awareness Month: Building a culture of cyber safety in your business

Read More >Ten key strategies to keep the cash flowing

Read More >